While estate planning allows you the freedom to choose who will receive your money and property upon your passing, struggling to determine who should receive your accounts and property at your death may prevent you from starting the process. You should not let this stop you from creating an estate plan, however. Whether it is naming a person or organization as your beneficiary in your last will and testament (also referred to as a will) or in a revocable living trust, making this important decision and having it officially documented is the best way to ensure that your wishes will be carried out.

What will happen without an estate plan? If you do not formally write out your wishes, the state will use its own default estate plan, outlined in state laws called “intestacy” rules, to give away your money and property. The exact amounts and order of priority for who will receive your money and property vary by state. Still, in general, the state’s plan will first give your money and property to your surviving spouse, then to your descendants (children or grandchildren), then to your parents, and then to your siblings and their children (your nieces and nephews), depending upon who has survived you.

Most importantly, the state—not you—decides how much each person will receive. For example, if you have more than one child, each child will receive an equal amount of your money and property. Depending upon the age difference between your children, this may not be the fair treatment you would have wanted. An older child will get their share immediately if the child has attained the majority’s age in your state (usually eighteen or twenty-one). However, a younger child (who has not attained adulthood) will have their share managed by a court-appointed individual, called a conservator or guardian, until the child becomes a legal adult. Additionally, your younger child may have to use his or her share to pay for things such as a first car or college tuition, whereas you may have been able to provide those items for your older child, who will now be able to use his or her share for other purposes.

If you are unmarried with no children, your money and property will be given to your parents. Depending on your parents’ relationship, and assuming that they survive you, these may not be the people you intend to leave your money and property to. Also, if your parents are older, receiving a large amount of money or property from you at your death could cause issues for them if they receive government benefits such as Medicaid for nursing home care.

If you are unmarried and have no children or living parents, your siblings will receive your money and property. Hopefully, this is what you would have wanted because this is the result. If this is not the outcome you want, you need to consider some other options.

Who are some other possible recipients? Now that you know who will receive your money and property, if you do nothing, consider who you do want to receive your money and property. With proper estate planning, you can help ensure that your money and property are given to those you want and used in the way you want. As alternatives to the individuals who may receive your money and property under the state’s plan, there are some other options for you to consider:

- Your unmarried significant other. Regardless of how long a relationship the two of you have been in, if your state’s law does not recognize your relationship, the state’s plan may not treat your significant other as your spouse. If you want this person to receive any of the accounts or property solely in your name, you need to create an estate plan.

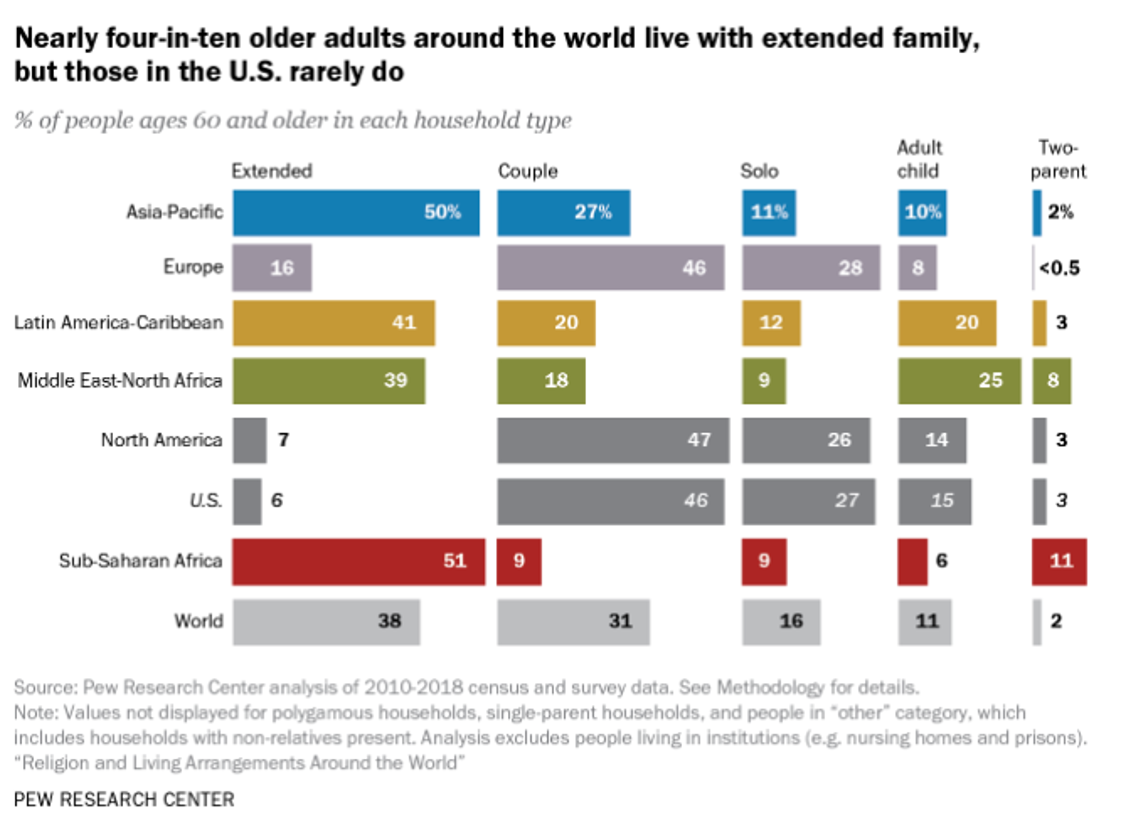

- Your extended family members (nieces, nephews, cousins). While these individuals could receive your money and property under the state’s plan, many people would have to be deceased for them to be first in line. Therefore, if you have a close relationship with your nieces, nephews, or cousins, and you want any of them to receive money or property, you will need to take proactive steps.

- Your close friends. Many people view their close friends as their family. Although you may not be blood-related, the bond between you may be stronger than what you share with those you are related to. If this is the case, providing for your close friends in your estate plan may be a great way to show you care and help them have a brighter and more prosperous future.

- Your pets. According to a survey conducted in 2019–2020 by the American Pet Products Association, 85 million families own pets. Just like children, pets need to be cared for and loved after you have passed. Depending on the type of animal you have, your pet may have a substantial life expectancy. Using your money and property to care for your pets after your passing is a great way to continue to provide for them and could be a great financial help to whomever you choose to care for them.

- Your favorite charity. In addition to the options discussed above, is there a cause that is particularly near and dear to your heart? Your money and property may be a great resource to further a cause and leave a lasting legacy. If this is the case, you must plan. By planning, you can meet with the charity and discuss your gift and determine how it will be used.

Important Points to Remember

- It is your stuff, and you have the right to choose who gets it and how it gets used. Do not listen to the preconceived notions that people have regarding who should get your money and property: “You should leave everything to your family, no matter how distant the relation,” or “Because you are a religious person, you should give everything to your church.”

- Just because a person has a special circumstance (is currently receiving government benefits, has an addiction, or is going through a divorce) does not mean you have to leave them out of your estate plan. If someone is important to you, they are worth providing for. We can help you craft your gift in a way that will protect your loved one while protecting your hard-earned money and property.

- When deciding who to leave money or property to, always name a backup or plan for the money or property if the person has passed or the charitable organization is no longer in existence. You get to choose what happens to your money and property. Do not allow someone to step in and derail your intentions because of an unforeseen circumstance.

- Estate planning is not a one-and-done endeavor. Once you have signed your documents, it is important that you periodically review your choices. Life is constantly changing; we want to make sure that the individuals or organizations you chose years ago to leave money and property to are still the same individuals or organizations you want to leave money and property to today.

Taking the first step can be hard, but we are here to help you. There are many reasons why you may be postponing your estate planning. We are here to help you navigate your fears and concerns and create a plan that addresses them and allows you to take control of your money and property, leaving a legacy designed by you, not the state. We are available for in-person and virtual consultations. Please contact us today.